new orleans sales tax percentage

Sales is under Consumption taxes. A county-wide sales tax rate of 5 is applicable to localities in Orleans Parish in addition to the 445 Louisiana sales tax.

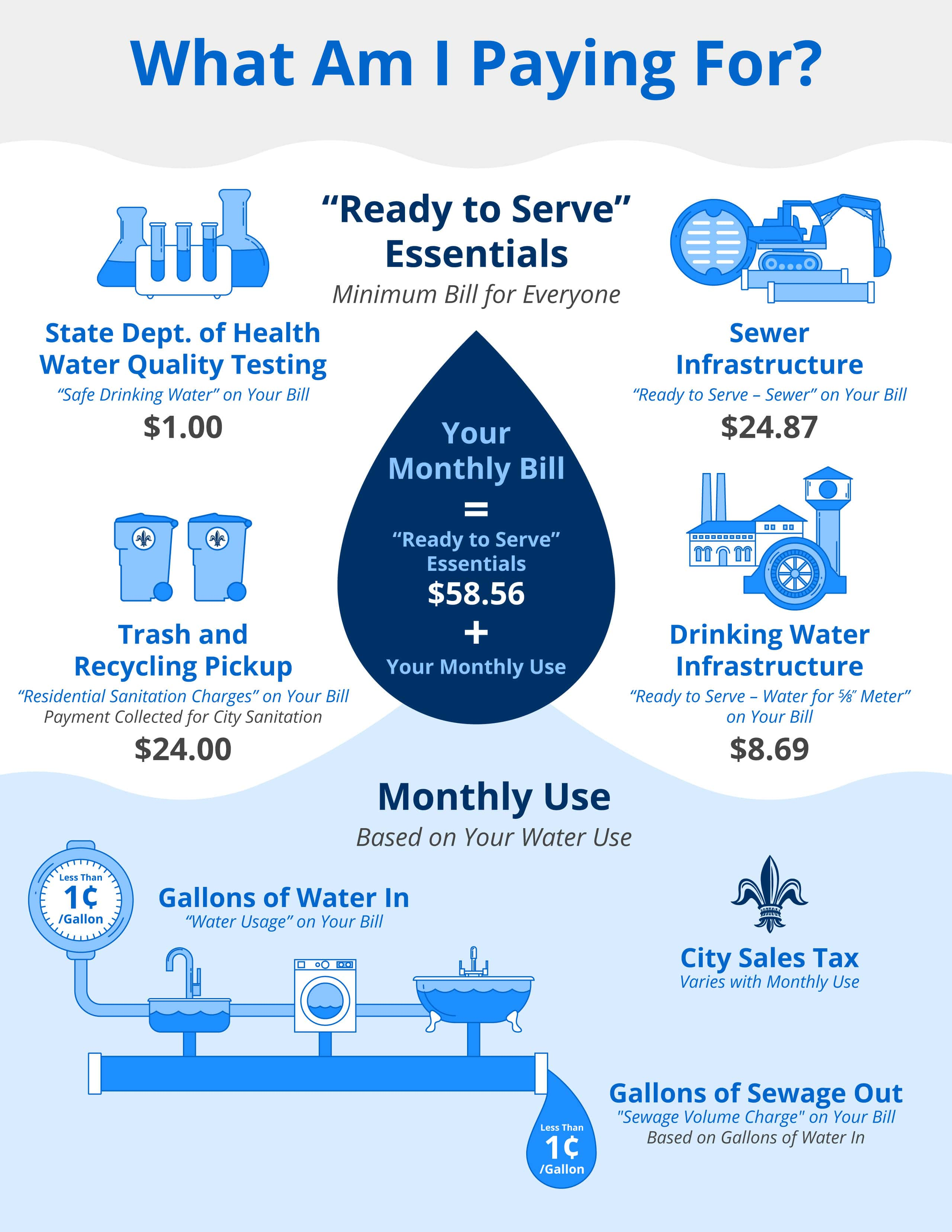

Rates Fees Charges Sewerage Water Board Of New Orleans

General sales tax formally at 5 will now be 52495 food for further consumption and prescribed medications column b on the sales tax form formally at.

. The 2018 United States Supreme Court decision in South Dakota v. The 945 sales tax rate in new orleans consists of 445 louisiana state sales tax and 5 orleans parish sales tax. 150-874 of the City Code includes any establishment or person engaged in the business of furnishing sleeping rooms cottages or cabins to transient guests.

And Occupancy Fees 500 or 1200RoomNight Eff. Morial Exhibition Hall Authority Food and Beverage Tax. The New Orleans sales tax rate is.

Noble LA Sales Tax Rate. This is the total of state parish and city sales tax rates. Occupancy Privilege Tax Eff.

The Orleans Parish Sales Tax is 5. In addition to taxes car purchases in Louisiana may be subject to other fees like registration title and plate fees. What is the tax on food in New Orleans.

8 rows TaxFee Description Rate Effective Date Required Filing Tax Form. New Orleans LA Sales Tax Rate. Sales Tax and Use Tax Rate of Zip Code 70117 is located in New orleans City Orleans Parish Louisiana State.

Orleans Parish sales tax. General sales tax formally at 5 will now be 52495 food for further consumption and prescribed medications Column B on the sales tax form formally at 45 will now be 47495. The Orleans County sales tax rate is.

4 rows The current total local sales tax rate in New Orleans LA is 9450. City Reminds Residents of Extended Deadline for 2022 Property Tax Bill Payments. Heres how Orleans Parishs maximum sales tax rate of 9695 compares to other.

The minimum combined 2022 sales tax rate for New Orleans Louisiana is. Orleans Parish in Louisiana has a tax rate of 10 for 2022 this includes the Louisiana Sales Tax Rate of 4 and Local Sales Tax Rates in Orleans Parish totaling 6. Newellton LA Sales Tax Rate.

The Louisiana sales tax rate is currently. Click here for more information and downloadable sales tax forms from the Bureau of Revenue. New Roads LA Sales Tax Rate.

The state sales tax rate in New Mexico is 5125. For more information about this tax. New Iberia LA Sales Tax Rate.

Average Sales Tax With Local. Effective Starting September 1 2020 to Present 5 Sales Tax - Eff. You can find more tax rates and allowances for Orleans Parish and Louisiana in the 2022 Louisiana Tax Tables.

The minimum combined 2022 sales tax rate for Orleans County New York is. The Parish sales tax rate is. How much sales tax do they take in New Mexico.

New Sarpy LA Sales Tax Rate. Concerning local sales tax occupational license and other requirements. The current total local sales tax rate in New Orleans LA is 10000.

Some cities and local governments in Orleans Parish collect additional local sales taxes which can be as high as 0245. Louisiana has state sales tax of 445 and. You can find these fees further down on the page.

Negreet LA Sales Tax Rate. The City of New Orleans today reminded residents the deadline for the 2022 property tax payments has been extended to March 15 2022. New orleans la sales tax rate the current total local sales tax rate in new orleans la is 9450.

North Hodge LA Sales. The New York state sales tax rate is currently. B most of new orleans is located within orleans parish and is subject to a 9 percent sales tax.

Orleans Parish Sales Tax Rates for 2022. Louisiana collects a 4 state sales tax rate on the purchase of all vehicles. There are also local taxes of up to 6.

Noble la sales tax rate. New Llano LA Sales Tax Rate. The case is Halstead Bead v.

Richard in the federal court for the Eastern District of Louisiana. The definition of a hotel according to Sec. 675 Occupancy Tax - Eff.

All establishments are required to charge 5 on room rentals and. In addition to sales tax food and beverage establishments in the City of New Orleans and the New Orleans airport must also regis-ter for collect and remit the EN. Start yours with a template.

Estimated Combined Tax Rate 945 Estimated County Tax Rate 500 Estimated City Tax Rate 000 Estimated Special Tax Rate 000 and Vendor Discount 00084. This is the total of state and county sales tax rates. The City of New Orleans sales tax rate on renting of any sleeping room will increase from 4 to 5.

The December 2020. On March 17 2022 NTUFs Taxpayer Defense Center TDC was in New Orleans to protect interstate commerce from the labyrinthine sales tax reporting system in Louisiana. Taxpayer Defense Center Goes to New Orleans.

3 rows The 945 sales tax rate in New Orleans consists of 445 Louisiana state sales tax. 92020 total of 1175. Louisiana state sales tax.

3 State Sales tax is 445. Norco LA Sales Tax Rate.

Sales Taxes In The United States Wikiwand

Sales Taxes In The United States Wikiwand

Alabama Sales Tax Guide For Businesses

6 Differences Between Vat And Us Sales Tax

Sales Taxes In The United States Wikiwand

Pennsylvania Sales Tax Guide For Businesses

Sales Taxes In The United States Wikiwand

Louisiana Sales Tax Small Business Guide Truic

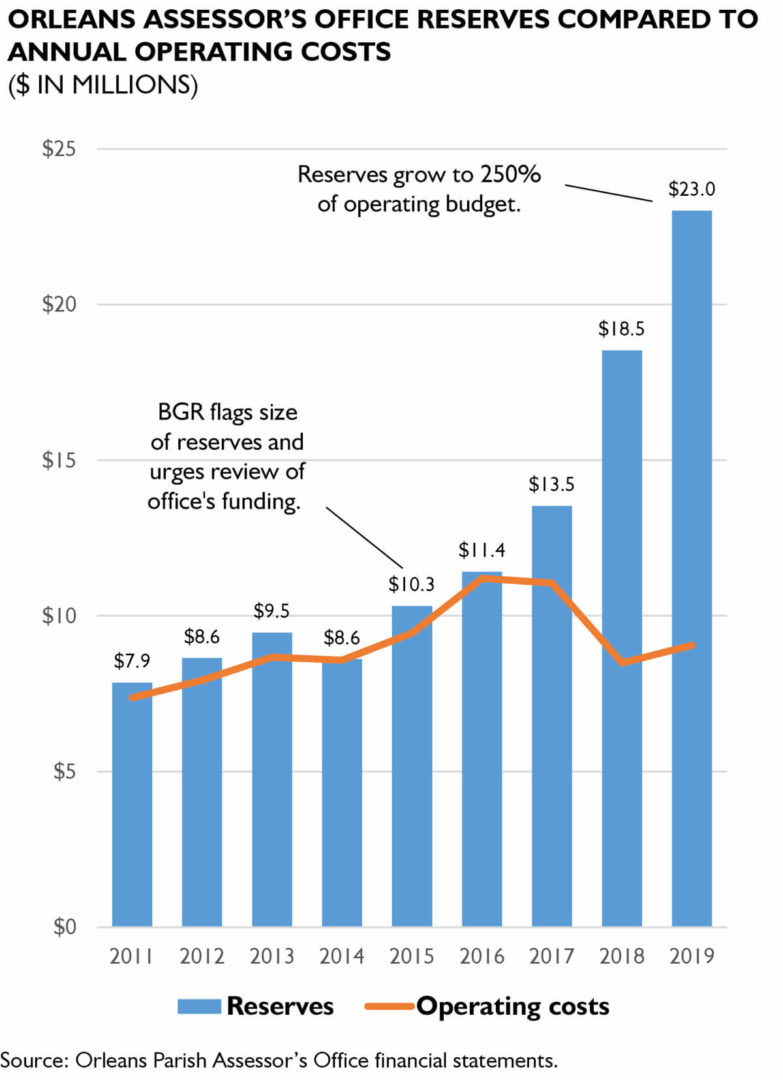

Policywatch Revisiting Assessment Issues In New Orleans

New Orleans Louisiana S Sales Tax Rate Is 9 45

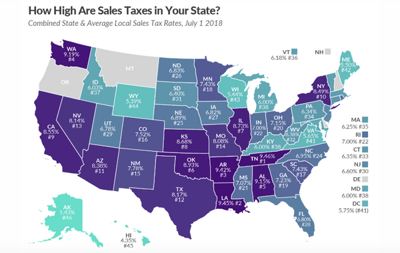

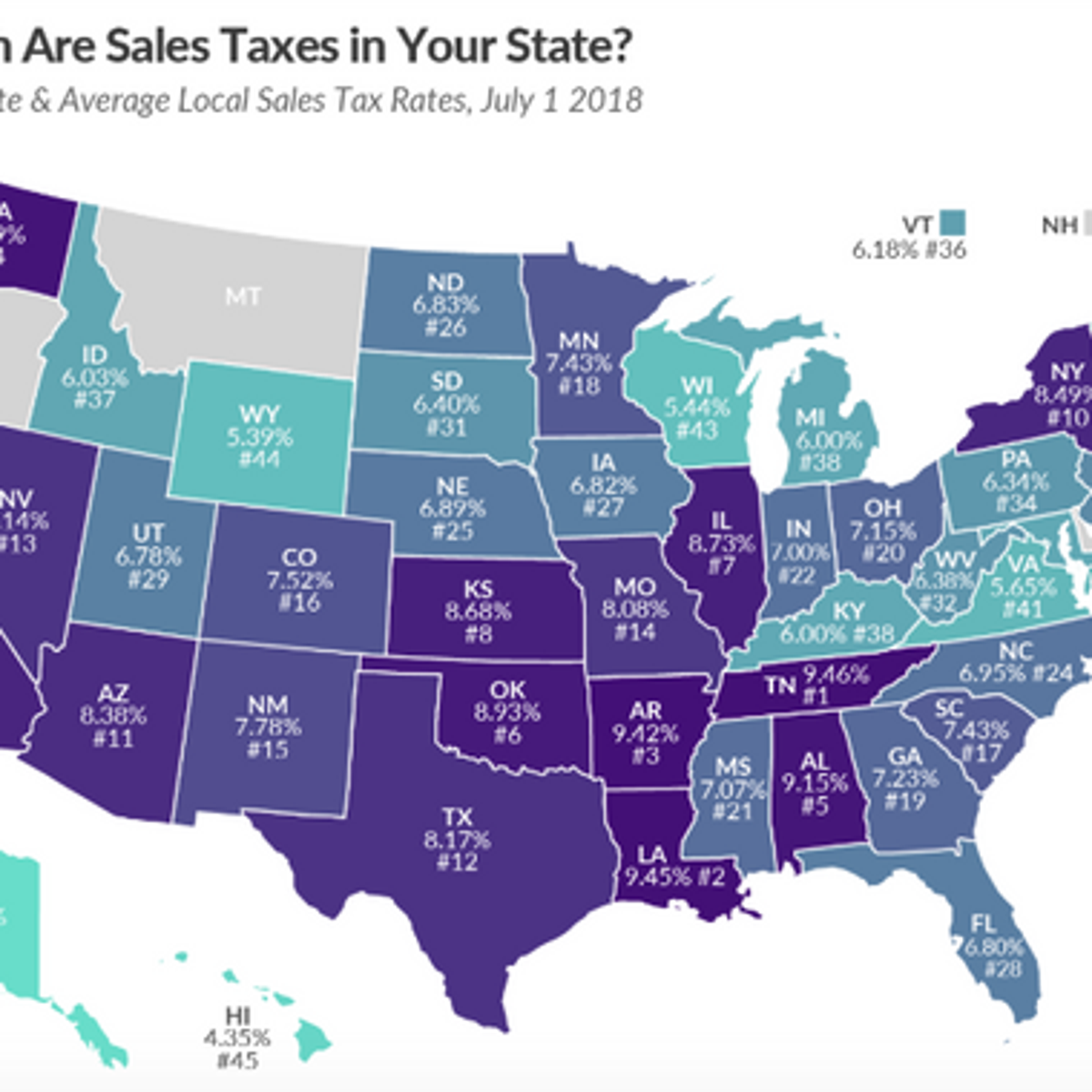

Louisiana S 9 52 Sales Tax 2nd Highest In U S Biz New Orleans

Understanding Historic Districts In New Orleans

Policywatch Revisiting Assessment Issues In New Orleans

Louisiana Doesn T Have The Highest Sales Tax Rate In The Country Anymore Local Politics Nola Com

Louisiana Doesn T Have The Highest Sales Tax Rate In The Country Anymore Local Politics Nola Com